Car Insurance Claim for Damages caused by Animals

Does car insurance help in case of an animal attack? Will insurance cover the incurred loss? Read on to know more about Car Insurance Claim …

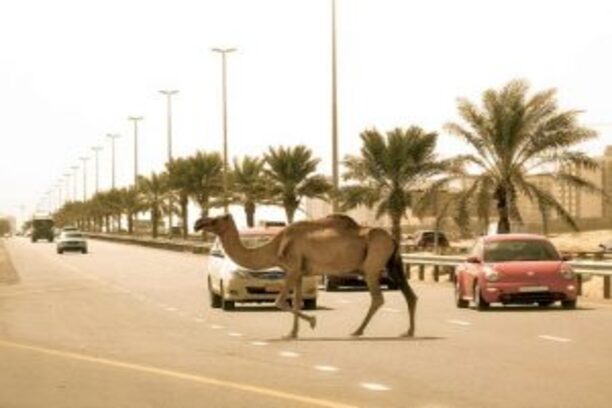

You’re enjoying a long drive on a deserted road and out of the blue a camel bumps into your car. You tried hard to avoid crashing, but unfortunately the vehicle lost control and ended up colliding.

As a car owner you’d never know from where damages can occur. But nevertheless, you must be prepared to face damages caused even by animals. Whether the animal deliberately rammed into the car or unintentionally play a role to cause damage, in both cases you are liable for compensation under a comprehensive car insurance policy. However, a third-party liability insurance doesn’t offer coverage for damages caused by animals. In this piece, we explain various scenarios where animals can cause extensive damage and steps you need to follow for filing a claim.

Various kinds of damages caused by animals

Animals can meddle with your vehicle not only on roads but also when parked. They can tamper with your car in the parking lot, chewing up wires or breaking the glasses. Here are various situations where animals can create havoc:

- Cats or dogs leaving scratches or patches on the paints

- A rodent chewing up the wires, seats, seatbelts and upholstery.

- A pet animal ripped off the seats and tore the upholstery apart.

- A large animal such as camel, deer or oryx dashed into your car, causing a dent, puncture or shattered windscreen.

- A rotting carcass of a dead animal inside or outside your car caused significant damage.

Filing a car insurance claim for animal-related damages

Filing a claim for animal related damage is similar to the claims you submit for road accidents. You need to collect all evidence of the damages to substantiate your claim. Here are the steps you need to follow while submitting a claim:

Report the accident

As soon as you notice an animal-caused damage notify your insurance provider by making a quick call. If there are any causalities caused such as injury to you or a third-party due to an animal collision, inform the police and obtain a report.

Collect proof

Take pictures and video recordings of the damages. Attach this evidence to your claim to help the inspection team verify the extent of damage and estimate the amount of compensation you are eligible for. Provide details of your policy number and the police report if any.

Cooperate with the survey team

If the damage has caused significant loss, the insurance company may send a team to the site to verify the genuineness of your claim. Cooperate with the investigation and prepare for answers to any questions. You can at this point ask for roadside assistance to tow your vehicle to the nearest service station under your policy cover.

Get your claim processed

After your car insurance claim application has been processed and approved by the authorities, your insurer will directly pay for the expenses to the service provider (cashless claim) and you are good to go.

Preventing animal attacks on your car

Even though you are liable for a financial compensation under comprehensive insurance, it’s not the worth the headache to submit claims each time an animal messes with your vehicle. Also note that the repair cost must be greater than the deductible, if not you’re liable to pay it yourself.

Prevention is always better than cure and the best remedy is to take precautions to reduce the frequency of such troubles.

- Avoid parking in the open or secluded areas.

- Don’t eat inside the car as food can attract rodents and other pests.

- Avoid storing any kind of eatables in your car.

- Always close the windows and doors.

- Drive vigilantly on the highway and avoid going too close to any animal.

- Reduce the duration of keeping your car unused for long periods.

No matter how cautious on your part, animal attacks are unpredictable. In such cases where something bad happens, you can rely on your motor insurance policy. After all, that’s the reason it’s taken for.

Equip your car with comprehensive car insurance policy

A comprehensive vehicle insurance secures your car against damages caused by uncontrolled factors and alleviates the losses you incur. Even if you don’t drive too often, it’s important you buy extensive motor insurance protection. As trusted car insurance brokers in Dubai in the UAE insurance market we can help you fetch the best car insurance policies from AXA Insurance, Orient Insurance, RSA online and other trusted car insurance companies in Dubai.

Talk to our team now on +971 4 3577 997