Insurance is an essential service for living in a modern world. There are endless risks that can affect individuals, families, and businesses. The reason to buy Insurance Policy online in UAE is that it protects the buyers from risks and sometimes minimizes them. Investing a small amount of money, either monthly or annually will protect you from most risks.

Types of Insurance Coverage

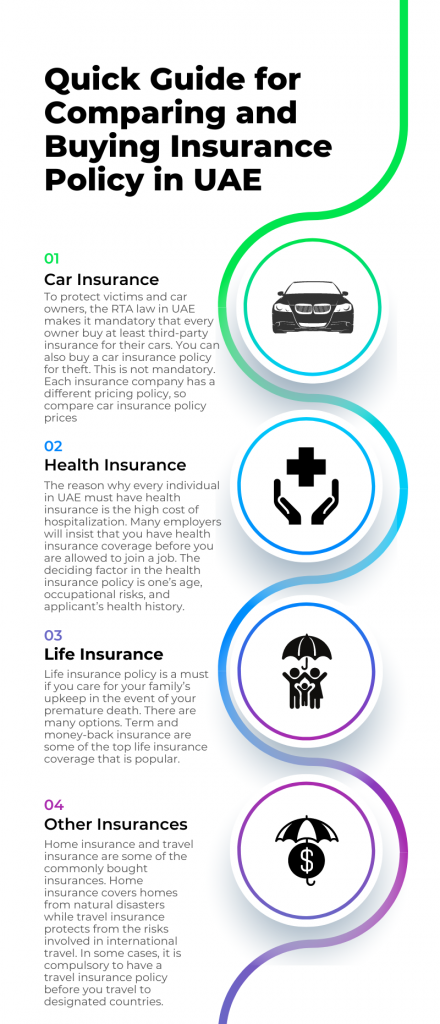

Insurance coverage is available for many purposes. Common types of insurance are Car Insurance, Health Insurance, Home Insurance, Travel Insurance, and Life Insurance. Getting insurance is simple and easy. To buy insurance of any type, you should approach one of the insurance brokers in UAE if you live in Dubai, Abu Dhabi, Sharjah, or elsewhere in the UAE. The other way is to buy insurance policy online in UAE. The advantage of buying online is that you will save time and be able to compare costs – it is comfortable, easy, and quick. Once you buy insurance policy online in UAE, you will receive it at the address you give the insurance broker or the insurance company.

Auto Insurance (Car Insurance)

Most people and families in big cities like Dubai, Abu Dhabi, Sharjah, and other major cities in the UAE use cars for travelling. This is the most preferred transportation but is also laden with risks. The main risk is the liability arising to the car owner in the event of an accident. Liabilities can be huge, and not all car owners can afford them.

To protect victims and car owners, the RTA law in UAE makes it mandatory that every owner buy at least third-party car insurance. You can also buy a car insurance policy for theft. This is not mandatory. Each insurance company has a different pricing policy, so compare car insurance policy prices before you order insurance.

Health Insurance

The reason why every individual in UAE must have health insurance is the high cost of hospitalization. Many employers will insist that you have health insurance coverage before you are allowed to join a job. The deciding factor in the health insurance policy is one’s age, occupational risks, and applicant’s health history.

Typical, the premium you pay for health insurance will go up as you grow older. Get quotes from a couple brokers for affordable health insurance in UAE

Life Insurance

Life insurance policy is a must if you care for your family’s upkeep in the event of your premature death. There are many options. Term and money-back insurance are some of the top life insurance coverage that is popular.

Before you buy a life insurance policy contact a few insurance brokers in UAE. Insurance companies (Dubai, Abu Dhabi, and Sharjah) in UAE have a wide range of policies that will fit the needs of most people across different age groups.

Other Insurances

Home insurance and travel insurance are some of the commonly bought insurances. Home insurance covers homes from natural disasters while travel insurance protects from the risks involved in international travel. In some cases, it is compulsory to have a travel insurance policy before you travel to designated countries.

Advantages of Buying from Brokers

We recommend you to buy an insurance policy online in UAE from a reputed broker with a reputation. The advantages of using insurance brokers are many. He can study your requirement in-depth and give you personalized service which may not be available from the insurance company directly. In many cases, brokers represent more than one insurance company. It is an advantage when you request insurance quotes. Not always you can go with the insurance quote; there are fine details you might miss if you are not an experienced buyer.

There is a big difference between insurance companies. Broadly, you should prefer an insurance company with a reputation for having a simple and quick settlement process. Ask your insurance brokers in UAE whether the company they represent has a good track record of customer satisfaction for fast processing. You can also research online and ask your insurance broker to buy a policy for your choice.

Buying insurance is the only way to protect yourself from risks in life, so don’t wait for another day – do it now; do it today itself.