Why Comprehensive Employee Group Medical Insurance is Important for your Business in UAE?

Employees and workers are the most valuable assets of a business. If your business is located in the UAE, it is obligatory for you to take medical insurance for employees in UAE. Instead of covering each employee with a separate policy, your company can choose to buy group medical insurance and provide medical insurance protection to all of them.

What is Group Medical Insurance?

Group medical insurance is employer-initiated health coverage protection for its employees. The cost of buying group medical insurance in UAE as against individual policy is cost-effective for the company. Because the cost is distributed among a large number of members. Places like Dubai, Sharjah, Ajman, Umm Al Quwain, Ras Al Khaimah, and Fujairah are some of the major centers where native and foreign businesses operate on a large scale. If you are operating here, get insurance for your employees; it is important.

What Benefits do You Get?

You can provide comprehensive group insurance for employees in Dubai and other cities of the UAE. When your company buys group insurance for your employees, all eligible medical expenses will be borne by the insurance company at good medical facilities. The benefit is your company’s finances will not be strained.

Your employees will get cashless treatment at the hospital. You or your patient-employee do not have to pay cash during cashless treatment. The advantage is that the patient or his family can concentrate on their regular work. It will save your employees from the hassles associated with borrowing money and paying interest on it.

The expenses incurred include ambulance hire, pre- and post-operative medical bills, medicine purchases, expenses incurred during the recovery process at home, and nursing costs covered.

Multiple Plan Options

Depending on what medical exigencies you foresee, you can choose the right plan. Our expert advisors can advise what is best for you, based on your risk perceptions and statutory minimum requirements.

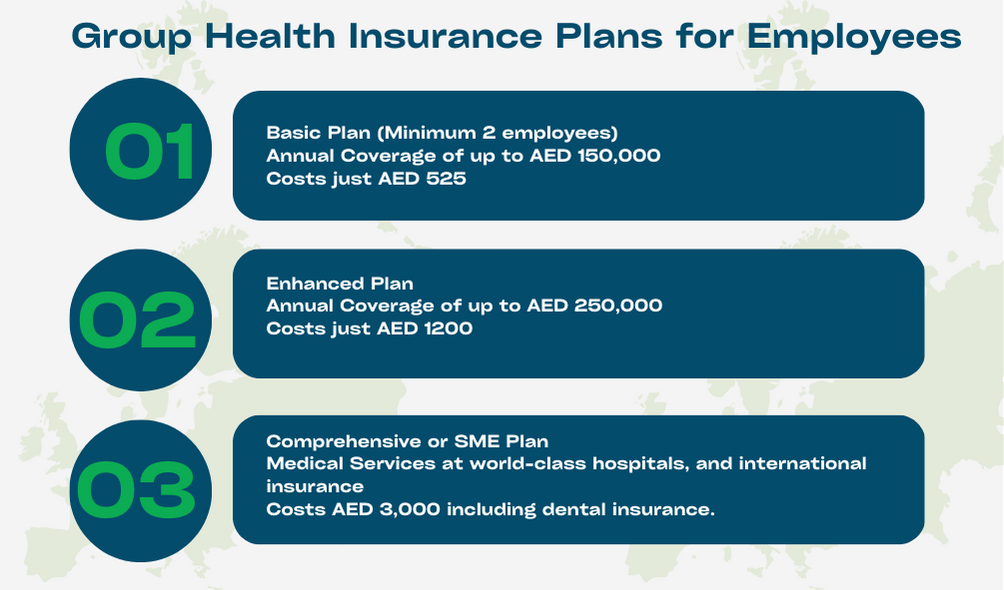

Here are three great medical insurance plans for employees in the UAE

Basic Plan – provides annual coverage of up to AED 150,000 for medical requirements, maternity coverage for female employees, and treatment under the alternative medicine system. It costs just AED 525; taxes are extra.

Enhanced Plan – Get everything included in the basic plan plus coverage up to AED 250,000 for the medical requirement. You will also get direct access to specialists. Premiums for this plan start from AED 1,200.

Comprehensive Plan – Get medical services at world-class hospitals, and international insurance. Premium starts at AED 3,000 including dental insurance.

Group Medical Insurance not only protects the company from financial losses due to unexpected health problems that afflict its employees but also raise the employees’ morale. The investment that companies make will return back multiple times in the form of higher productivity and loyalty.

Taking out group health insurance in the UAE requires expert knowledge, which we specialize in. To get the best benefits, talk to our insurance advisors. A small investment in it can result in higher employee productivity.

Group Medical Insurance in UAE – Eligibility, and Benefits

If you are new to buying group medical insurance, you will be surprised by the vast options we give our customers. What is best for you is a company-specific decision to take. We can assist you with specific details and eligibility. Please click here for tips, and benefits you will get.

Tips To Buy A Group Health Insurance Policy in UAE

Companies must strive to get optimum benefits for their employees when they buy a group health insurance policy. Everything might seem simple, but there are many differences on which you must focus before you take a final decision. Please click here for tips, best practice advisory about group medical insurance policy.

Importance of buying group medical insurance for employees

Having good group medical insurance in UAE is important for several reasons: It attracts and retains employees, It provides financial protection. Please click here for importance of buying group medical insurance for employees in UAE.

FAQs

How Many Employees Needed to Get Group Health Insurance?

Minimum 2 employees for Basic Plan.

How much does basic group health insurance cost

AED 525 per Employee (LSB)

AED 750 per Employee (HSB)

* LSB – Employees whose monthly gross pay is 4,000 AED or less comes under Lower Salary Band (LSB)

* HSB – Employees whose monthly gross pay is more than 4,000 AED comes under High Salary Band (HSB)

Is group health insurance cheaper than individual?

Yes. Group health insurance is typically far cheaper than individual policies.

Make an Enquiry for your Employees Group health insurance.